|

For this year, the lifetime estate tax exemption amount is $5.49 million dollars (an increase from $5.45 million in 2016). This means that if a person passes away in 2017, up to $5.45 million would be exempt from the federal estate tax. Anything over is subject to the federal estate tax rate (with a maximum tax rate at 40%).

The lifetime gift tax exemption amount is also $5.49 million dollars for individuals. An individual can leave up to $5.49 million to their heirs and not have to pay a gift tax for 2017. For a married couple, that will be $10.98 million dollars that they can give away without paying the federal estate or gift tax. The annual gift exclusion remains the same at $14,000, meaning that an individual can give $14,000 to as many individuals as he or she would like in a given year.

0 Comments

Most of us start the new year with new goals (or goals from last year), but by mid-February, those efforts can lose steam. Have you made it your goal to create a plan for your family if something were to happen to you? Here’s what a well thought out estate plan can help you accomplish:

Is estate planning on your to-do list this year (or the last few years) but you haven’t gotten around to it? Now is the time!

Many of us have goals of what we want to accomplish in life and I’m sure the most important ones are centered around our family and their future. We can easily set aside the estate planning process because it’s a difficult topic to think about and plan for. But it can be one of the best things you can do to protect your loved ones, your health, and your money. To get estate planning off your to-do list, here are some things to get started with: Consider your children - Estate planning helps you protect your children throughout their lifetimes.

Consider your health

Review beneficiary designations

Make it a priority to accomplish your goals and have a plan in place or update your estate if needed. A well-thought out plan is an invaluable gift that keeps on giving to you and your family. "You don't have to see the whole staircase; just take the first step." ~Martin Luther King, Jr.

Planning for the future can be quite overwhelming. It's hard to see the future and plan exactly what will take place in case something happens to you. And this could possibly be holding you back from planning your future. But just taking that first step will make it easier and worthwhile as things fall into place, questions get answered and the burden will become lighter as you have a peace of mind that your loved ones will be taken care of. I can’t believe Thanksgiving is already here and Christmas is just around the corner! I love the holidays as we gather with our friends and family and enjoy each other’s presence, conversations, and delicious food! It’s a great time to count our blessings, reminisce about wonderful memories, make new ones, and be thankful for all of our loved ones in our lives.

I just had a few thoughts this year as we spend time with your loved ones. It’s a great opportunity to think about your estate plan - getting one started or letting others know about it. Being around your family and loved ones may also help you see who would best serve in certain roles or who may need some extra protection in the future. Having an estate plan may not be a priority right now and starting the conversation can be uncomfortable, but having that estate plan in place can give you a peace of mind that your loved ones are cared for. After all, time flies and lots of things can happen in a few short years; our kids grow up, move away, get married, have their own kids, career changes, etc. But once we have some planning, we can be assured that our family and loved ones are protected and cared for. We are grateful for the relationships we have made, your confidence in us, and loyalty over the years. We wish everyone a wonderful holiday weekend! Happy Thanksgiving!! Have you ever called a doctor’s office to get medical information about your spouse? They may have told you that they cannot share information about the patient with anyone but the patient or an authorized representative. Privacy laws protect the patients from disclosure of their confidential medical information. To be an authorized representative, a HIPAA authorization must be signed by the patient.

What is HIPAA? HIPAA stands for Health Insurance Portability and Accountability Act. This privacy law is intended to protect against the unauthorized release of your private medical information. What is a HIPAA Authorization and Waiver? One of the essential health care documents that should be included in any estate plan portfolio is the HIPAA Authorization and Waiver form. The HIPAA Authorization and Waiver is a stand-alone document that authorizes your health care providers to release information concerning your otherwise confidential medical information to the individuals (ie. your spouse) you have designated to act on your behalf in the event of disability and to those who you would also want to have such access. Without a signed HIPAA form, the medical community is very conservative about releasing medical records because they will face stiff penalties. When you have capacity and can act on your own, it’s not a problem to sign a HIPAA form. However, should you ever become incapacitated and unable to authorize the release of your medical information, problems can arise. But with this form, it allows your loved ones to be informed about your medical condition and who can then assist to managing and directing care for you. Here's another example of the importance of a HIPAA document: Imagine you were overseas on a business trip and a close friend calls and says your son was in a car accident and was taken to the hospital. When you frantically call the hospital to inquire about his condition, the nurse tells you that she cannot legally give you that information. Because he was an adult, the hospital needed authorization from your son that specifies those persons to whom the hospital could release information. Feeling helpless, you could only worry and stress as you travel back home to your son. In planning for the future, make sure to have this form executed and include it with your other important health care documents in your estate plan portfolio. You would want someone you trust to know and receive your medical condition and medical information to help care for you in case something were to happen to you. Your “estate” includes all of your assets. This could include assets held in your name alone or held jointly with others. It also includes property that you may not use during your lifetime, such as the proceeds from an insurance policy or retirement plan proceeds that remain at your death.

Here’s a list of the following assets that are part of your estate:

The value of your estate is the “fair market value” of all of your assets (before deducting for debts, mortgages, obligations, etc.). The value of your estate is important in determining whether your estate will be subject to probate, subject to estate taxes after your death, and whether your beneficiaries could later be subject to capital gains taxes. It’s also important to know, and to what extent, if your estate will have the resources available to pay for your financial and medical expenses in the event of your incapacity. As part of the estate planning process, it’s crucial to ensure that there will be sufficient resources to pay for any necessary expenses and to make sure your loved ones will be taken care of. Do your family members know what online accounts you have? Do they know how to handle them in case something were to happen to you?

More than likely, people don’t advertise to others about what digital assets they have or how those assets should be handled if something were to happen to them. But dealing with digital assets after someone dies is becoming a challenge for families and loved ones. Family members can't just rifle through a desk anymore to find the accounts and assets because they’re mostly found online. And back in the days, pictures were carefully placed in photo albums and stored on bookshelves and coffee tables. But now, I’m sure most of you have photos stored on your smartphones, computer, or cloud storage. Today, it’s becoming more important and necessary to plan ahead for access to your digital property (ie. passwords, online accounts, and electronically-stored information) and leave clearer instructions for your family members in your estate plan to handle your digital assets. By creating a proper digital estate plan, you can help your family:

Here are some steps to take to get started on your digital estate plan:

Digital technology plays such an integral to both our personal and professional lives that we should properly plan ahead as to managing it if something were to happen to us.

But what is digital property? Digital Property is any information that exists in digital form, either online or on an electronic storage device, and includes the information necessary to access the digital asset. It includes data, Internet accounts, and other rights in the digital world, such as contractual rights and intellectual property rights. Data are the files and information stored and used by computers (such as e–mails, word processing documents, spreadsheets, pictures, audio files, and movies). This data may be stored locally on a computer’s hard drive or on removable media, or it may be stored remotely and accessed over the Internet. Here’s a more specific list of what's included in your digital estate:

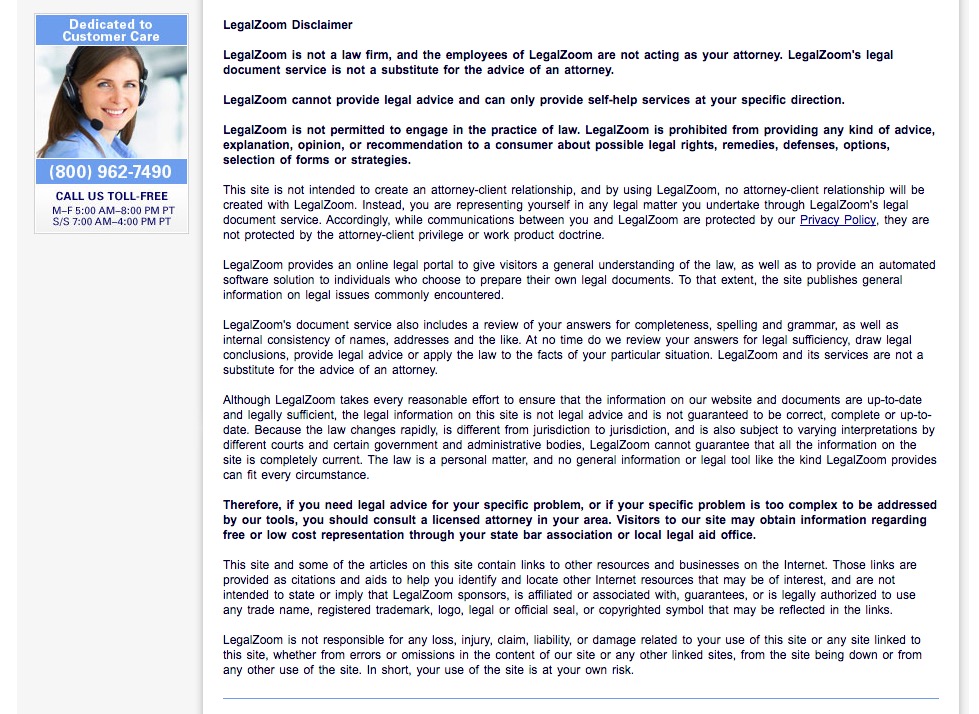

With all the privacy issues and encrypted electronic data, if a person has not planned ahead, it may be difficult if not practically impossible to locate and access certain types of digital property. Make sure you have at least a list of your accounts, a designation of who would manage and have access to it, and plan for how you would want it managed. Most of us go to a doctor when our bodies aren’t feeling well, a dentist when our teeth hurt, a mechanic when there is a problem with our car, and an accountant for our taxes. Some of these things can be done by yourself, but it probably wouldn’t be the best idea. Doing your own estate plan can be simple, but it can also have some very costly ramifications if done improperly. That amount of money or time you may be saving initially really may not be worth it on the long run. Do-it-yourself document preparation websites are certainly attractive, especially if their prices are substantially lower than attorney’s fees. It’s also seems convenient at first as people don’t have to even step out of their house to meet anybody, but sit at their home computer and log in. But would you trust an online company to gather enough information about your unique situation, your family, and your financial assets to prepare documents that control how those assets are distributed after you pass away or how to handle your affairs if you become incapacitated and no longer able to clarify your intentions? Companies, such as LegalZoom or RocketLawyer, lure people in by giving them a false sense of security. They assure you that once you’ve completed their questionnaire and a plan is drafted and signed, you can set it aside and not have to worry about the future anymore. These services want to make you believe that estate planning and implementing your life goals are as easy as filling in the blanks on a standardized form. And they try to convince people that the advice of an attorney is simply not necessary. However, DIY estate planning sites are unreliable and one should proceed with caution because more harm may result than good. Let’s take LegalZoom as an example. Its disclaimer speaks for itself about its inadequacy. Here is a snapshot of their disclaimer found online and below are the reasons why these preparation services are unreliable. 1) LegalZoom is not your attorney and cannot give legal advice. In the beginning of its disclaimer, it states in bold: “LegalZoom is not a law firm, and the employees of LegalZoom are not acting as your attorney. LegalZoom’s legal document service is not a substitute for the advice of an attorney. LegalZoom clearly states that it is not a law firm, cannot give legal advice, and is not acting as your attorney. It even states that it’s prohibited from providing any advice or recommendation to a consumer. In addition, LegalZoom does not review your answers for legal sufficiency, draw legal conclusions, provide legal advice or apply the law to the facts of your particular situation. 2) There is NO attorney-client privilege or relationship. LegalZoom also states in its disclaimer that NO attorney-client relationship will be created. This site is not intended to create an attorney-client relationship, and by using LegalZoom, no attorney-client relationship will be created with LegalZoom. Instead, you are representing yourself in any legal matter you undertake through LegalZoom's legal document service. Accordingly, while communications between you and LegalZoom are protected by our Privacy Policy, they are not protected by the attorney-client privilege or work product doctrine. Attorney-client privilege means that any and all communication between the client and attorney is protected. However, LegalZoom states that there is NO attorney-client relationship between you and LegalZoom. Any information that is submitted through LegalZoom is not protected and may be provided to other attorneys and employees for the "purpose of determining your need for legal services." Therefore, attorneys and employees, whom you have never met or spoken to, have access to your private and confidential information. Are you comfortable with that? 3) Mistakes may not be discovered until it’s too late. So many variables come into play in drafting an estate plan and without proper feedback, your wishes may not be fully implemented and consequently have unintended results. People may not know about mistakes in their will or living trust until it’s too late. Why? Because if a serious legal mistake is made, you’ll never know because it won’t become apparent until you become incapacitated or pass away. Errors in a will, for example, are revealed after death, when it’s too late to change the document or ask the deceased what his or her intentions were. Initially, LegalZoom can give you a peace of mind. But you don’t really know if there are problems or mistakes until after you are gone, and these mistakes could end costing you and your family more money than what you thought you may have been saving. 4) Using DIY forms can actually be more costly. These forms can create a false sense of security, but mistakes may not become evident until it's too late. And the people who are left to handle the mistakes are usually the people that were supposed to be protected. If there are legal mistakes in your estate plan, you or your successors may have to deal with the costs of fixing it. Money spent now could be spent many times over to address legal issues that were not discovered when using the DIY preparation services. Creating your estate plan and legacy through DIY services could lead to untold errors and problems that may require expensive legal services and litigation on top of the frustration, confusion, grief that your loved one is going through. This is exactly what a properly drafted estate plan is supposed to avoid. So it may be worth it to spend a little more to have your planning done right. Your loved ones are worth it. 5) The law changes Legal Zoom clearly states in its disclaimer that “Because the law changes rapidly,…LegalZoom cannot guarantee that all the information on the site is completely current.” Laws constantly change and LegalZoom even admits that it cannot guarantee that the information is correct, complete or up-to-date. 6) LegalZoom only provides general information. The law is a personal matter, and no general information or legal tool like the kind LegalZoom provides can fit every circumstance. It states: LegalZoom provides an online legal portal to give visitors a general understanding of the law, as well as to provide an automated software solution to individuals who choose to prepare their own legal documents. To that extent, the site publishes general information on legal issues commonly encountered. LegalZoom provides an “automated software solution to individuals” and publishes “general information on legal issues commonly encountered.” But every family has their own different dynamics, and it is difficult and nearly impossible for an automated software solution to address any issues or concerns in each family’s circumstance. It cannot provide information that would be tailored to each family’s specific and unique needs. It can only offer guidance based on a majority of its customers answering questions a certain way, but that doesn’t necessarily make it applicable to an individual’s unique situation.

Is a Do-It-Yourself estate plan for you? Yes, and no. It may be appropriate to do so if you have a modest estate in your name only and you simply only wish to leave your assets to your closest surviving relative. But for someone with an even slightly more complicated situation, creating a Will or a Living Trust online creates risks that could have lasting financial and emotional consequences on those who matter most. What was supposed to be easy and less burdensome for your loved ones, can be more difficult and expensive in administering your estate and could lead to probate litigation. |

About the AuthorChristine Chung, Esq. Archives

March 2020

Categories

All

|

|

Home | About Us | Attorneys | Virtual Services | Practice Areas | FAQs | Contact Us

© 2018 Law Offices of Christine Chung. All rights reserved. Disclaimer/Privacy Notice |

RSS Feed

RSS Feed