|

Most of us start the new year with new goals (or goals from last year), but by mid-February, those efforts can lose steam. Have you made it your goal to create a plan for your family if something were to happen to you? Here’s what a well thought out estate plan can help you accomplish:

0 Comments

Is estate planning on your to-do list this year (or the last few years) but you haven’t gotten around to it? Now is the time!

Many of us have goals of what we want to accomplish in life and I’m sure the most important ones are centered around our family and their future. We can easily set aside the estate planning process because it’s a difficult topic to think about and plan for. But it can be one of the best things you can do to protect your loved ones, your health, and your money. To get estate planning off your to-do list, here are some things to get started with: Consider your children - Estate planning helps you protect your children throughout their lifetimes.

Consider your health

Review beneficiary designations

Make it a priority to accomplish your goals and have a plan in place or update your estate if needed. A well-thought out plan is an invaluable gift that keeps on giving to you and your family. Do your family members know what online accounts you have? Do they know how to handle them in case something were to happen to you?

More than likely, people don’t advertise to others about what digital assets they have or how those assets should be handled if something were to happen to them. But dealing with digital assets after someone dies is becoming a challenge for families and loved ones. Family members can't just rifle through a desk anymore to find the accounts and assets because they’re mostly found online. And back in the days, pictures were carefully placed in photo albums and stored on bookshelves and coffee tables. But now, I’m sure most of you have photos stored on your smartphones, computer, or cloud storage. Today, it’s becoming more important and necessary to plan ahead for access to your digital property (ie. passwords, online accounts, and electronically-stored information) and leave clearer instructions for your family members in your estate plan to handle your digital assets. By creating a proper digital estate plan, you can help your family:

Here are some steps to take to get started on your digital estate plan:

Joint Tenancy remains a popular form of property ownership as people tend to elect this form of ownership to avoid probate. Many of my clients stated that when they bought a house, they chose to create a joint tenancy without really going any further as to what that entails. Joint tenancy with right of survivorship means that each person owns the entire asset (undivided equal share), not just part of it. When one owner passes away, the person's share immediately passes to the other owners in equal shares, without going through probate. We’ve all been told that joint tenancy can be a simple and inexpensive way to avoid probate, and this is sometimes true.

But careful consideration should be made for the potential tax consequences and other problems of joint tenancy ownership. Here are some of the disadvantages of joint tenancy which far outweigh the advantages:

Joint Tenancy does have its advantages, such as:

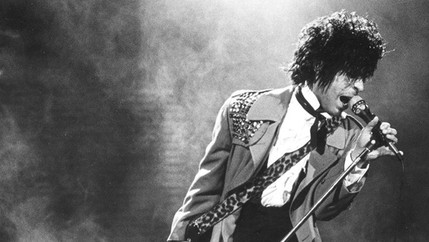

Before placing your property in a certain type of ownership, I highly recommend becoming familiar with all types of property ownership and taking into consideration your objectives and consequences to your heirs. At the age of 57, Prince died unexpectedly in his home at Paisley Park. He left fans worldwide in shock and sadness, but he also left behind his estate that is reportedly worth at least $250 million. And his could be worth even more with his posthumously sold albums. In the four days after he passed, he sold 650,000 albums (both digital and physical), according to Nielsen Music. The questions that now remain are who will have control of his estate? Who will make the decisions about his unreleased recordings? Who will inherit his real estate? His earnings? According to The New York Times, Prince died intestate, meaning without a will. His sister, Tyka Nelson, filed court documents with the Carver County District Court in Minnesota to request the Court to appoint a special administrator to preserve Prince’s estate until a personal representative is appointed. Shortly after, Bremer Trust, NA, a corporate trust company, was appointed by the Court, giving the company authority to manage and supervise Prince's assets and identify his heirs. Ms. Nelson’s court petition state that Prince died without a current spouse, kids, or surviving parents. She also states in the documents that “I do not know of the existence of a will.” If no will or other estate planning documents turn up, Prince’s surviving family members (ie. Ms. Nelson and his half-siblings) may have to go through a costly, drawn-out family battle over his financial estate and his legacy. Because of a lack of estate planning, it is likely more than half of his estate will be paid in estate taxes and legal fees in order to determine who will inherit. Putting an estate plan is so important to protect your loved ones and to save them the time, headache, and money in handling your estate. Please make sure you and your family have some kind of planning in place in case something happens to you. The IRS has set new estate and gift tax limits for 2016. The estate and gift tax exemption will now be $5,450,000 per individual, up from $5,430,000 in 2015. This means that an individual can leave $5.45 million to their heirs and pay no federal estate or gift tax for 2016 (considering he or she did not previously make any gifts during his or her lifetime). A married couple will be able to exempt $10,900,000 from federal estate and gift taxes. But it's not automatic. Under the rules of portability, the surviving spouse must elect to use portability by filing an estate tax return for the estate of the first spouse to die, even when no tax is due.

Separate from this lifetime gift exemption amount is the annual gift tax exclusion amount. The annual gift exclusion remains the same at $14,000 and an individual can give $14,000 to as many individuals as he or she would like. Reference: http://www.forbes.com/sites/ashleaebeling/2015/10/22/irs-announces-2016-estate-and-gift-tax-limits-the-10-9-million-tax-break/ With the tax filing deadline around the corner, and though filing your taxes is not exactly thrilling, it needs to be done. It can be a bit overwhelming to have to dig through your files and gather all your paperwork to file taxes. But after taking this first step, the rest of the process should be easier and less stressful.

Here’s a checklist of what you will need to gather before your tax appointment: 1) Your Social Security number, your spouse’s and/or dependents’ Social Security numbers 2) Last year’s tax return 3) All W-2 and/or 1099-MISC forms including any contractor’s income 4) Self-employed bookkeeping records 5) Schedule K-1s 6) Bank saving interest and dividend statement from credit unions, stockbrokers, etc. 7) Unemployment compensation report 8) Social Security benefits report 9) Gambling winning or lottery winning statement 10) State Income tax refund from last year 11) Withdrawal statement of your 401K, IRA, Pension and Annuity, etc. 12) IRA contribution for last year 13) Education expenses for your children and yourself and student loan interest 14) Health and dental insurance / Obama Care premium payment and associated expenses 15) House mortgage interest records 16) House property tax records 17) Auto registration fees 18) Childcare expense, care provider name, SSN or Tax ID-FEIN, and address 19) Business, business travel, rental property, stock, bond, real estate, job related moving expenses, etc. 20) Charitable donations made throughout the year 21) 1099-C forms, if you canceled any debt during the year 22) Record of alimony received 23) Energy-efficient home improvement records and receipts As a mother of a 2-year-old, I can’t imagine what would happen to my son if something were to happen to me and my spouse. I would want to ensure that my child would always be taken care of by the people I want, in the way I want, no matter what happens.

If the unthinkable happens to the parents and without proper planning, here’s what could happen:

No one wants to think of the inevitable, but it’s best to be prepared and have a well thought-out plan to protect your children’s well-being and care if in case something were to happen. Now that the empty champagne bottles and party hats have been put away (hopefully), we can finally breathe and work towards our goals for the new year. If you don’t have an estate plan in place yet, working on getting one should be a top priority for 2015. A common misconception is that estate planning is for the wealthy, but anyone with a house or have children needs to make a plan for what happens if they become incapacitated or pass away. And it actually involves a wide array of estate planning options. This involves using trusts to distribute your property without the probate court and health care directives to express your wishes regarding medical treatment

If you do have an estate plan in place already, GREAT! It’s the perfect time to review and see if there any are life changes that may require a few modifications to your estate plan. Some things to consider: 1) Are you able to easily locate your estate planning documents? And does your trustee, representative or agent know about them and where they are located? 2) Did you get married or divorce? 3) Did you have a child or a grandchild that needs to be mentioned in your plan? 4) Are there any significant changes in your children’s guardian nominations? Has anything happened either in your children’s lives or your guardian’s lives that may make you rethink things? Has the named guardian moved, get a divorce, remarry? 5) Did you buy a house? One of the most common mistakes is failure to update a plan after a home has been purchased or sold. Forgetting to transfer the new house into the trust may force your estate into probate, which is why a trust may have been created to avoid. 6) Did you move to another state? 7) Did you sell your business, retire, have significant change in assets or win the lottery? Any significant assets that you acquire should be transferred into your trust to avoid probate. 8) Have you lost a family member or friend who was named as a trustee, personal representative or agent in your estate plan? Or has anything happened in the past year that would impact your decision to have them administer your plan? Estate planning is not a one shot done deal – it’s a continuing process because our life journey is full of constant changes. While every milestone in your life does not mean that you need to update your estate plan, it’s important to think through the past year’s events to make sure that your estate plan will still take care of your family and loved ones just as you desired. You may have heard that it’s best to avoid probate because it's expensive and time-consuming. If you don’t have a proper estate plan in place, such as having a living trust, your estate may end up in probate. Probate in California is a court supervised process that is used to wind up a person's legal and financial affairs after death and is usually overseen by probate lawyers. In general, the greater the value of your probate assets, the higher probate will cost.

You want to make sure your loved ones are provided for and not have to worry about their inheritance being tied up in court and having to pay a big chunk of the inheritance to attorneys' fees, court costs, etc. But how much does it cost to go through the probate process? First of all, both the attorney and the personal representative (executor or administrator) are entitled to fees from your estate. The fees are determined by state law and based on a percentage of the gross estate value. (There are no deductions on loans or set-offs). Then, there are other fees such as court costs, publication costs, accounting, appraisal fees, bond fees and other expenses. A typical estate may incur $1,000 to $3,000 in court costs alone and other mandated fees. After adding all the fees and costs, probate can cost anywhere from 3% to 8% of your assets that could have been included in your distribution to your beneficiaries. How much are the fees paid to the attorney and personal representative? In California, the statutory fees for the attorneys and personal representative are broken down as follows:

For example, if your only asset in your estate is a $500,000 house, the statutory fee would be $13,000 based on the full $500,000:

Sometimes, the personal representative may waive his or her fees if it's usually a family member, but he or she may change their mind after they realize how much work and time is involved. And the fees are based on the gross value of the estate. So if there is a mortgage and the heir wishes to sell the property, the inheritance would be even less. On the other hand, a properly created and maintained living trust avoids probate. Your successor trustee winds up your financial matters, pay your last bills, and distributes your property according to your trust provisions without going to court and having to pay a significant amount in fees to the attorney and personal representative. |

About the AuthorChristine Chung, Esq. Archives

March 2020

Categories

All

|

|

Home | About Us | Attorneys | Virtual Services | Practice Areas | FAQs | Contact Us

© 2018 Law Offices of Christine Chung. All rights reserved. Disclaimer/Privacy Notice |

RSS Feed

RSS Feed