|

Joint Tenancy remains a popular form of property ownership as people tend to elect this form of ownership to avoid probate. Many of my clients stated that when they bought a house, they chose to create a joint tenancy without really going any further as to what that entails. Joint tenancy with right of survivorship means that each person owns the entire asset (undivided equal share), not just part of it. When one owner passes away, the person's share immediately passes to the other owners in equal shares, without going through probate. We’ve all been told that joint tenancy can be a simple and inexpensive way to avoid probate, and this is sometimes true.

But careful consideration should be made for the potential tax consequences and other problems of joint tenancy ownership. Here are some of the disadvantages of joint tenancy which far outweigh the advantages:

Joint Tenancy does have its advantages, such as:

Before placing your property in a certain type of ownership, I highly recommend becoming familiar with all types of property ownership and taking into consideration your objectives and consequences to your heirs.

0 Comments

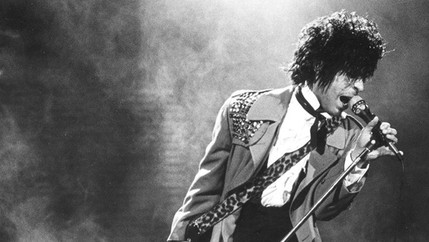

At the age of 57, Prince died unexpectedly in his home at Paisley Park. He left fans worldwide in shock and sadness, but he also left behind his estate that is reportedly worth at least $250 million. And his could be worth even more with his posthumously sold albums. In the four days after he passed, he sold 650,000 albums (both digital and physical), according to Nielsen Music. The questions that now remain are who will have control of his estate? Who will make the decisions about his unreleased recordings? Who will inherit his real estate? His earnings? According to The New York Times, Prince died intestate, meaning without a will. His sister, Tyka Nelson, filed court documents with the Carver County District Court in Minnesota to request the Court to appoint a special administrator to preserve Prince’s estate until a personal representative is appointed. Shortly after, Bremer Trust, NA, a corporate trust company, was appointed by the Court, giving the company authority to manage and supervise Prince's assets and identify his heirs. Ms. Nelson’s court petition state that Prince died without a current spouse, kids, or surviving parents. She also states in the documents that “I do not know of the existence of a will.” If no will or other estate planning documents turn up, Prince’s surviving family members (ie. Ms. Nelson and his half-siblings) may have to go through a costly, drawn-out family battle over his financial estate and his legacy. Because of a lack of estate planning, it is likely more than half of his estate will be paid in estate taxes and legal fees in order to determine who will inherit. Putting an estate plan is so important to protect your loved ones and to save them the time, headache, and money in handling your estate. Please make sure you and your family have some kind of planning in place in case something happens to you. What will happen to my Facebook account when I pass away?

Facebook has the option where you can set in advance whether you’d like to have your account memorialized or permanently deleted after you pass away. A memorialized account is a place for your friends and family to visit and share memories after a person has passed away. And since last year, Facebook now allows you to designate a “legacy contact” to manage your account. Once your account is memorialized, this person can post on your timeline after your death, such as share a final message. Other things he or she can do:

Your legacy contact currently is not able to:

If you want to designate your legacy contact:

Reference: https://www.facebook.com/help/1568013990080948 Spring is here, which means it’s time to finally clean up those papers that are piling up everywhere!

In this digital age, many people and businesses are going the paperless route. But many others tend to keep a ton of paperwork and let the paper pile high. Below is a guideline of what to keep or toss or shred (unless you are keeping things for tax purposes). And keep in mind that most statements, bills, etc. are available to view online. If you still can’t part with the paperwork, another option is to scan the documents and store the file on your computer. KEEP FOR 1-3 MONTHS:

KEEP FOR ONE YEAR:

KEEP FOR ABOUT 6-7 YEARS

KEEP FOR AWHILE:

KEEP FOREVER

A good rule of thumb if you’re deciding what to save or shred is to think about how difficult that document is to replace and if keeping these documents will make it easier for your trustee or personal representative to manage your affairs and your estate. Many times, clients have asked me where they should keep their trust documents. Safe deposit box? Fireproof Safe? The local bank? My trustee? My kids?

The answer is really simple: in a safe and reliable place. But what does that mean? Far too often, essential information is difficult to locate quickly and easily. For example, important papers may be stored in various hard-to-find places (ie. shoebox, kitchen drawer, scraps of paper in the garage or office). In an emergency, family members may have to scramble and experience anxiety because they have to search for indispensable documents, names of contacts or phone numbers. Your trust documents are very important and should be kept in a safe place. But they also should be readily available if your Successor Trustee needs access to it immediately. One of the reasons for this immediate access is that banks, stock transfer agents, and title companies may request to see your Trust (or Certification of Trust) so that they can verify that they are dealing with the right person. Because your Successor Trustee may need to act on a moment's notice, we recommend that you let him or her know where to find your trust documents. The most convenient place is somewhere in your home or office, but make sure it's protected from fire or floods, such as in a fire and water-proof safe. If you decide to put your trust documents in a fireproof safe at home, you may want to let your trustee know how to access the safe (ie. the combination). At a minimum, place your original estate planning documents on a high shelf in your home or office. That way the documents can be protected from floods, small children or pets. In addition to keeping your estate planning documents in a safe and accessible place, you may think about leaving copies of your bank statements, past tax returns, contact information of key persons along with your estate plan documents to make the job of settling your estate be much less of a burden for the trustee. Keep in mind that any kind of organization will be helpful to your trustee and beneficiaries. Having your documents in order means your personal and business affairs will be handled efficiently, quickly and accurately. And more importantly, your loved ones will be more easily be able to take care of you and your needs according to your wishes. The IRS has set new estate and gift tax limits for 2016. The estate and gift tax exemption will now be $5,450,000 per individual, up from $5,430,000 in 2015. This means that an individual can leave $5.45 million to their heirs and pay no federal estate or gift tax for 2016 (considering he or she did not previously make any gifts during his or her lifetime). A married couple will be able to exempt $10,900,000 from federal estate and gift taxes. But it's not automatic. Under the rules of portability, the surviving spouse must elect to use portability by filing an estate tax return for the estate of the first spouse to die, even when no tax is due.

Separate from this lifetime gift exemption amount is the annual gift tax exclusion amount. The annual gift exclusion remains the same at $14,000 and an individual can give $14,000 to as many individuals as he or she would like. Reference: http://www.forbes.com/sites/ashleaebeling/2015/10/22/irs-announces-2016-estate-and-gift-tax-limits-the-10-9-million-tax-break/ With the tax filing deadline around the corner, and though filing your taxes is not exactly thrilling, it needs to be done. It can be a bit overwhelming to have to dig through your files and gather all your paperwork to file taxes. But after taking this first step, the rest of the process should be easier and less stressful.

Here’s a checklist of what you will need to gather before your tax appointment: 1) Your Social Security number, your spouse’s and/or dependents’ Social Security numbers 2) Last year’s tax return 3) All W-2 and/or 1099-MISC forms including any contractor’s income 4) Self-employed bookkeeping records 5) Schedule K-1s 6) Bank saving interest and dividend statement from credit unions, stockbrokers, etc. 7) Unemployment compensation report 8) Social Security benefits report 9) Gambling winning or lottery winning statement 10) State Income tax refund from last year 11) Withdrawal statement of your 401K, IRA, Pension and Annuity, etc. 12) IRA contribution for last year 13) Education expenses for your children and yourself and student loan interest 14) Health and dental insurance / Obama Care premium payment and associated expenses 15) House mortgage interest records 16) House property tax records 17) Auto registration fees 18) Childcare expense, care provider name, SSN or Tax ID-FEIN, and address 19) Business, business travel, rental property, stock, bond, real estate, job related moving expenses, etc. 20) Charitable donations made throughout the year 21) 1099-C forms, if you canceled any debt during the year 22) Record of alimony received 23) Energy-efficient home improvement records and receipts As a mother of a 2-year-old, I can’t imagine what would happen to my son if something were to happen to me and my spouse. I would want to ensure that my child would always be taken care of by the people I want, in the way I want, no matter what happens.

If the unthinkable happens to the parents and without proper planning, here’s what could happen:

No one wants to think of the inevitable, but it’s best to be prepared and have a well thought-out plan to protect your children’s well-being and care if in case something were to happen. Now that the empty champagne bottles and party hats have been put away (hopefully), we can finally breathe and work towards our goals for the new year. If you don’t have an estate plan in place yet, working on getting one should be a top priority for 2015. A common misconception is that estate planning is for the wealthy, but anyone with a house or have children needs to make a plan for what happens if they become incapacitated or pass away. And it actually involves a wide array of estate planning options. This involves using trusts to distribute your property without the probate court and health care directives to express your wishes regarding medical treatment

If you do have an estate plan in place already, GREAT! It’s the perfect time to review and see if there any are life changes that may require a few modifications to your estate plan. Some things to consider: 1) Are you able to easily locate your estate planning documents? And does your trustee, representative or agent know about them and where they are located? 2) Did you get married or divorce? 3) Did you have a child or a grandchild that needs to be mentioned in your plan? 4) Are there any significant changes in your children’s guardian nominations? Has anything happened either in your children’s lives or your guardian’s lives that may make you rethink things? Has the named guardian moved, get a divorce, remarry? 5) Did you buy a house? One of the most common mistakes is failure to update a plan after a home has been purchased or sold. Forgetting to transfer the new house into the trust may force your estate into probate, which is why a trust may have been created to avoid. 6) Did you move to another state? 7) Did you sell your business, retire, have significant change in assets or win the lottery? Any significant assets that you acquire should be transferred into your trust to avoid probate. 8) Have you lost a family member or friend who was named as a trustee, personal representative or agent in your estate plan? Or has anything happened in the past year that would impact your decision to have them administer your plan? Estate planning is not a one shot done deal – it’s a continuing process because our life journey is full of constant changes. While every milestone in your life does not mean that you need to update your estate plan, it’s important to think through the past year’s events to make sure that your estate plan will still take care of your family and loved ones just as you desired. Happy New Year from the Law Offices of Christine Chung!

We wish you the very best in the new year! No matter what you have planned for 2015, we hope you make it count! |

About the AuthorChristine Chung, Esq. Archives

March 2020

Categories

All

|

|

Home | About Us | Attorneys | Virtual Services | Practice Areas | FAQs | Contact Us

© 2018 Law Offices of Christine Chung. All rights reserved. Disclaimer/Privacy Notice |

RSS Feed

RSS Feed